Big news: Stanford to divest from coal mining companies

Stanford is the first major University of which I’m aware to divest from coal, but I’m convinced they won’t be the last. Coal is the low hanging fruit and the natural first target for those seeking to reduce emissions and increase pressure on the fossil fuel industry. Stopping coal export terminals and shutting down existing coal plants are two more natural steps in this process.

As a landmark article in the American Economic Review concluded in 2011, coal and oil fired electricity deliver negative net value added to the economy once you incorporate their societal costs. So the US will be better off once we shut down this industry. It will of course take decades, but it’s time to get started.

(Muller, Nicholas Z., Robert Mendelsohn, and William Nordhaus. 2011. “Environmental Accounting for Pollution in the United States Economy." American Economic Review vol. 101, no. 5. August. pp. 1649–1675. [https://www.aeaweb.org/articles.php?doi=10.1257/aer.101.5.1649])

This year is the the beginning of the end for the fossil fuel companies, though exactly how long this transition will take is an open question. Exxon accepted the framing related to stranded assets in late March, which is another major domino to fall. Assuming other major universities and investment funds follow in Stanford’s footsteps, pressure on the coal industry will increase. When markets shift, they do so with terrifying speed, as we found out during the financial crisis 6 years ago.

Here are the first few paragraphs of the statement from the trustees:

Acting on a recommendation of Stanford’s Advisory Panel on Investment Responsibility and Licensing, the Board of Trustees announced that Stanford will not make direct investments in coal mining companies. The move reflects the availability of alternate energy sources with lower greenhouse gas emissions than coal.

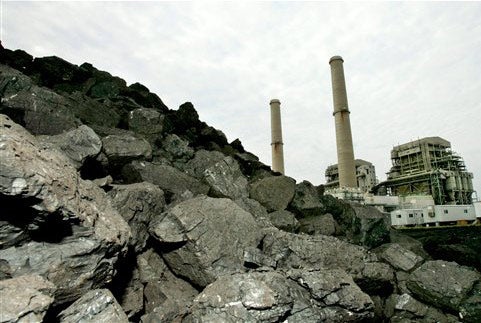

The Stanford University Board of Trustees has decided to not make direct investments of endowment funds in coal-mining companies. (David J. Phillip / AP)

Stanford University will not make direct investments of endowment funds in publicly traded companies whose principal business is the mining of coal for use in energy generation, the Stanford Board of Trustees decided today.

In taking the action, the trustees endorsed the recommendation of the university’s Advisory Panel on Investment Responsibility and Licensing (APIRL). This panel, which includes representatives of students, faculty, staff and alumni, conducted an extensive review over the last several months of the social and environmental implications of investment in fossil fuel companies.

Stanford's Statement on Investment Responsibility, originally adopted in 1971, states that the trustees’ primary obligation in investing endowment assets is to maximize the financial return of those assets to support the university. In addition, it states that when the trustees judge that "corporate policies or practices create substantial social injury,” they may include this factor in their investment decisions.