Energy efficiency is disrupting the traditional electric utility business model in the US

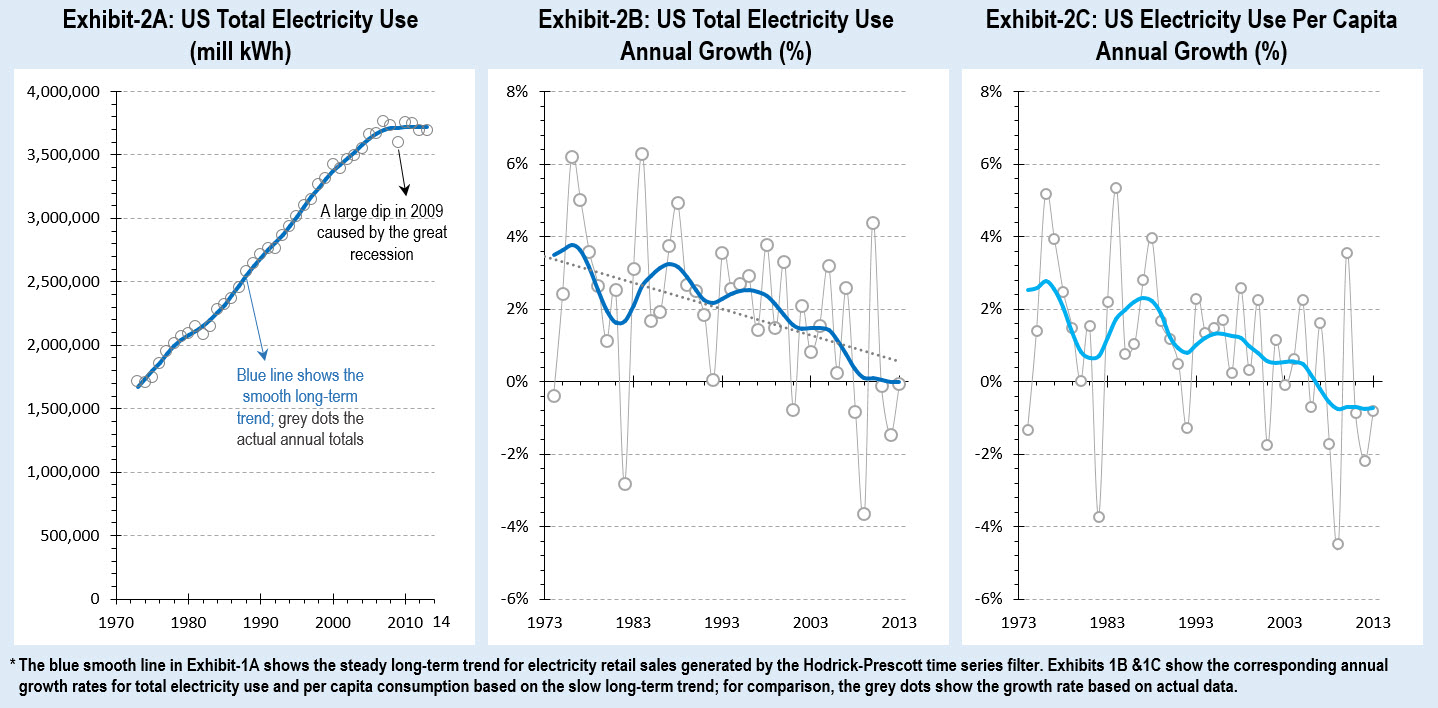

Here is a must read data analysis from my friends at CO2 Scorecard for those interested in what’s happening in the US utility industry. Electricity demand growth has slowed to zero in the past half decade, which is the culmination of long term trends associated with the implementation of efficiency policies, shifting production to less energy intensive industries, off shoring of some manufacturing, and other factors. The implication is that utility profits, which traditionally depend on growing electricity use, will not be rising anytime soon.

Here’s the summary:

We have reached a tipping point in America’s power sector. An industry that has sustained itself on Americans’ growing power demands has suddenly seen demand drop. This is making it difficult for US power utilities, under their current model, to turn a profit. What’s more, this is not a new trend. Using a time-series filter, an analysis of forty years of monthly end-use electricity data exposes a twenty-five year trend during which energy efficiency has steadily chipped away at the total electricity use in the US.

This would signal a pending contraction of the power generation sector, but seasonal, cyclical fluctuations are making it impossible for power providers to scale back. Increasingly warm summers in the US, combined with a demographic shift towards warmer states, have caused demand for electricity to actually increase during peak seasons.

The two diverging long-term patterns—falling electricity use and the increasing peak load—create a perfect storm for the finances of utility companies. While warmer summers require utilities to maintain generation capacity, warmer winters and energy efficiency starkly reduce demand the rest of the year, cutting into utility companies’ cash flow and bottom line.

This may be good news for consumers who watch their electricity bills drop, but it’s a real problem for power companies. If trends persist, they will be forced to increase the price of electricity to cover costs. But increased price will only strengthen the incentives for more electricity conservation and boost the demand for rooftop solar with net metering.

We see this action-and-reaction as a disruptive force that could trigger radical reform of the power sector’s obsolete business model.